Trading has become one of the most popular ways of making money online. With the increase in the popularity of online trading platforms, it can be challenging to choose the best platform for your investment goals. In this article, we will explore the best online trading platforms for making money in 2023.

Online trading platforms have revolutionized the financial industry. They provide a simple and convenient way for individuals to invest and make money from the comfort of their homes. With so many options available, it can be difficult to choose the best online trading platform that meets your needs.

Pros:

Accessibility: Online trading platforms are easily accessible, and you can trade from anywhere with an internet connection. This convenience is especially beneficial for those who cannot physically go to a traditional brokerage firm.

Low fees: Online trading platforms often offer lower fees compared to traditional brokerage firms. This is because online platforms have lower overhead costs and can pass on the savings to their customers.

Variety of investment options: Online trading platforms offer a vast range of investment options, including stocks, bonds, mutual funds, ETFs, and more. This allows investors to diversify their portfolios easily.

User-friendly interface: Most online trading platforms are designed to be user-friendly, making it easy for novice traders to get started.

Cons:

Lack of personalized advice: Unlike traditional brokerage firms, online trading platforms do not provide personalized advice or guidance. This means that investors are responsible for making their investment decisions, which can be overwhelming for some.

Dependence on technology: Online trading platforms rely heavily on technology, and system malfunctions or internet connectivity issues can result in delayed trades or other technical difficulties.

Risk of fraud: Online trading platforms have been known to attract scammers and fraudsters who take advantage of unsuspecting investors. It is crucial to research a platform thoroughly before signing up and investing.

Emotional investing: Online trading platforms make it easy for investors to make impulsive trades, leading to emotional investing. This can result in rash decisions that harm the investor’s overall portfolio.

What to Consider When Choosing an Online Trading Platform

Before choosing an online trading platform, it is essential to consider the following factors:

Security

The security of your investment should be your top priority. Ensure that the online trading platform you choose has robust security measures in place to protect your personal and financial information.

Fees

Different online trading platforms charge different fees for their services. Ensure that you choose a platform with transparent and reasonable fees.

Trading Tools

The best online trading platforms offer a variety of trading tools to help you make informed investment decisions. Look for platforms with real-time data, charting tools, and analytical tools.

Customer Support

It is crucial to choose an online trading platform with excellent customer support. You should be able to contact the platform’s support team easily and receive timely responses to your queries.

User-Friendliness

The online trading platform should be user-friendly, making it easy for you to navigate and execute trades.

The Best Online Trading Platforms

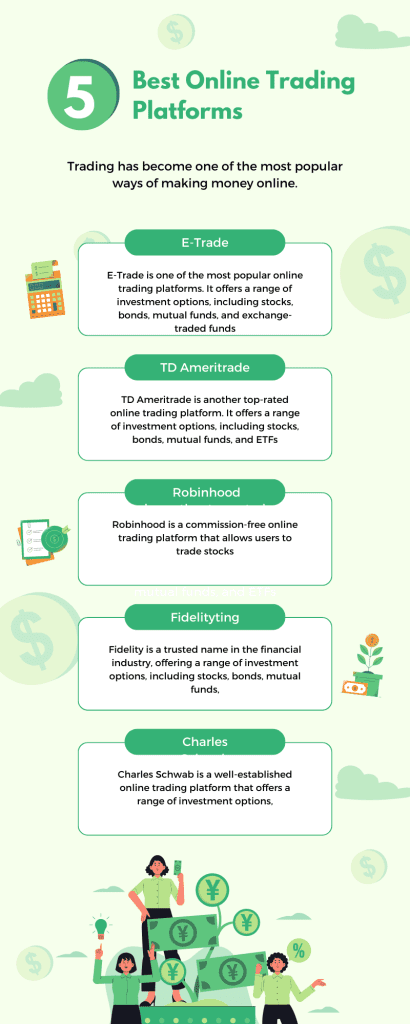

Based on the factors mentioned above, the following are the best online trading platforms for making money in 2023:

E-Trade

E-Trade is one of the most popular online trading platforms. It offers a range of investment options, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). E-Trade charges reasonable fees and provides an extensive selection of trading tools.

TD Ameritrade

Robinhood is a commission-free online trading platform that allows users to trade stocks, options, and ETFs. Robinhood’s user-friendly interface and easy-to-use mobile app make it an attractive option for beginner traders.

TD Ameritrade is another top-rated online trading platform. It offers a range of investment options, including stocks, bonds, mutual funds, and ETFs. TD Ameritrade also provides excellent customer support and a variety of trading tools.

Robinhood

Robinhood is a commission-free online trading platform that allows users to trade stocks, options, and ETFs. Robinhood’s user-friendly interface and easy-to-use mobile app make it an attractive option for beginner traders.

Fidelity

Fidelity is a trusted name in the financial industry, offering a range of investment options, including stocks, bonds, mutual funds, and ETFs. Fidelity also provides a variety of trading tools and excellent customer support.

Charles Schwab

Charles Schwab is a well-established online trading platform that offers a range of investment options, including stocks, bonds, mutual funds, and ETFs. Charles Schwab’s user-friendly interface and excellent customer support make it a top choice for beginner traders.

FAQs

Can I start trading on these platforms with little to no experience?

While online trading platforms are user-friendly and designed to accommodate novice traders, it is recommended that you have a basic understanding of investing before getting started. You can educate yourself by reading books, taking online courses, and practicing with paper trading accounts.

Are there any risks involved in online trading?

Yes, online trading comes with risks, including the possibility of losing money. It is crucial to develop a sound investment strategy and practice proper risk management to minimize the risks.

What is the minimum investment required to start trading on these platforms?

The minimum investment required to start trading on these platforms varies depending on the platform. Some platforms allow you to start with as little as $1, while others require a higher initial investment. Be sure to check the platform’s requirements before signing up.

Can I trade on these platforms outside of the United States?

Most of these platforms allow users from various countries to trade, but there may be restrictions depending on the platform and the country you reside in. Be sure to check the platform’s policies before signing up.

What happens if the online trading platform goes bankrupt?

In the event of a platform bankruptcy, your assets should be protected by the Securities Investor Protection Corporation (SIPC), which provides insurance coverage for up to $500,000 per account. However, it is always advisable to spread your investments across multiple platforms to minimize the risk of losing everything in case of a platform failure.

Conclusion

Choosing the best online trading platform is crucial for your investment success. Before selecting a platform, consider factors such as security, fees, trading tools, customer support, and user-friendliness. The five online trading platforms mentioned above are the best options for making money in 2023.

Overall, online trading platforms offer a great opportunity to invest and grow your wealth, but it is essential to approach them with a level head and an understanding of the potential risks involved. With proper research, risk management, and a sound investment strategy, online trading can be an excellent way to achieve financial success in the long run.

Passive Earning Start Earning Passively Today

Passive Earning Start Earning Passively Today