The cryptocurrency market has exploded in popularity, with more and more people interested in investing and trading digital assets. One common question that many people ask is, “Can you make $100 a day with crypto? Cryptocurrency trading involves buying and selling digital assets on an exchange in an attempt to generate profits.

While it can be a lucrative venture, it’s important to note that the market is highly volatile and risky. It’s essential to research and understand the market, evaluate potential investments, and develop a sound trading strategy before diving into cryptocurrency trading.

In this article, we’ll explore the requirements for trading cryptocurrencies, tips and tricks for making $100 a day with crypto trading, and the pros and cons of different methods of earning money with cryptocurrencies, such as investing, mining, peer-to-peer lending, and staking.

By the end of this article, you’ll have a better understanding of how the cryptocurrency market works and what it takes to potentially earn profits in this exciting and rapidly evolving industry.

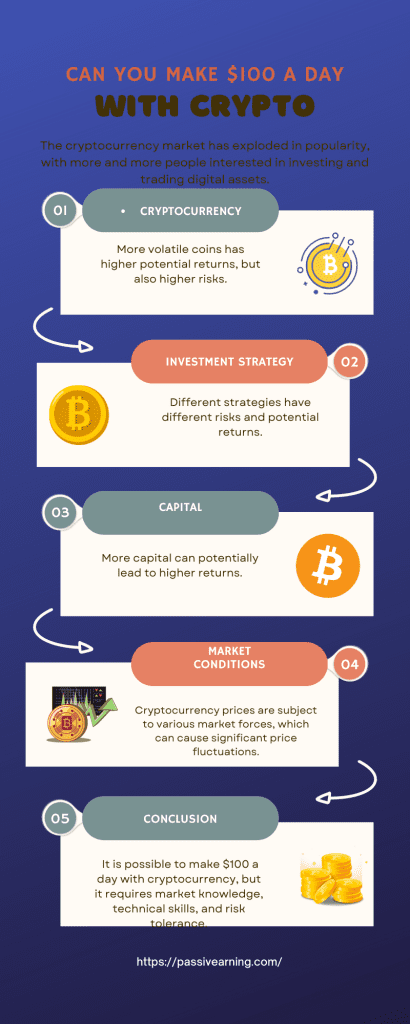

Firstly, not all cryptocurrencies are created equal. Some cryptocurrencies are more volatile than others, which means they can fluctuate more in value in a shorter period. Therefore, investing in a more volatile cryptocurrency can potentially provide higher returns but also comes with higher risks.

Secondly, the strategy you use to invest in crypto plays a crucial role in determining your returns. You could opt to trade actively, buy and hold, or use automated trading bots. Each of these strategies has its advantages and risks, and you should carefully consider your goals and risk tolerance before choosing a strategy.

Thirdly, the amount of capital you have to invest also affects your potential returns. If you have a larger investment capital, you can potentially make more profits than if you had a smaller capital.

Lastly, market conditions play a significant role in determining your returns. Cryptocurrency prices are subject to various market forces such as demand and supply, news and events, and government regulations. These factors can cause significant price fluctuations, and it’s important to stay updated and adjust your investment strategy accordingly.

| Factors | Impact on Earnings |

| Cryptocurrency | More volatile coins has higher potential returns, but also higher risks. |

| Investment strategy | Different strategies have different risks and potential returns. |

| Capital | More capital can potentially lead to higher returns. |

| Market conditions | Cryptocurrency prices are subject to various market forces, which can cause significant price fluctuations. |

Remember that investing in cryptocurrencies carries risks, and it’s important to do your research and seek professional advice before making any investment decisions.

How Does Trading Cryptocurrencies Work?

To buy cryptocurrencies, you need to create an account on an exchange and verify your identity. Once your account is verified, you can deposit funds into your account and start buying cryptocurrencies.

It is essential to understand cryptocurrency market trends and analyze price charts to make informed trading decisions. Cryptocurrency prices can be volatile, and it is important to have a good understanding of market trends to minimize risk and maximize profits.

What Are the Requirements for Trading Cryptocurrencies?

To trade cryptocurrencies successfully, you need to have knowledge and experience in cryptocurrency trading. It is also important to have a trading plan and manage risk effectively. You should only invest money that you can afford to lose and not let emotions guide your trading decisions.

Getting Started With Cryptocurrency

To start trading cryptocurrencies, you will need to open an account with a cryptocurrency exchange. There are many exchanges to choose from, and it’s important to do your research to find a reputable and secure platform.

Once you have chosen an exchange, you will need to complete the registration process, which typically involves providing your personal information and verifying your identity.

This is an important step to ensure the security of your account and comply with anti-money laundering regulations.

Most exchanges accept popular cryptocurrencies like Bitcoin and Ethereum, as well as fiat currencies like USD and EUR. The funding process may vary depending on the exchange, but it typically involves transferring funds from your bank account or another cryptocurrency wallet to your exchange account.

Best Platforms to Trade Cryptocurrencies

There are many cryptocurrency exchanges to choose from, each with its advantages and disadvantages. Here are some of the most popular exchanges and how they compare:

Binance – Binance is one of the largest and most popular cryptocurrency exchanges in the world. It offers a wide range of trading pairs and low fees, but it is not available in some countries.

Coinbase – Coinbase is a well-known and user-friendly exchange that is popular among beginners. It offers a limited selection of cryptocurrencies but has high fees compared to other exchanges.

Kraken – Kraken is a reputable and secure exchange that offers advanced trading features and low fees. However, it may not be as user-friendly as other exchanges.

Gemini – Gemini is a regulated exchange that offers a limited selection of cryptocurrencies but has low fees and a user-friendly interface.

What Are the Top Factors in Evaluating a Cryptocurrency?

When evaluating a cryptocurrency to trade or invest in, there are several key factors to consider:

Technology – The technology behind a cryptocurrency is a key factor in its long-term potential. Look for cryptocurrencies with innovative and scalable technology.

Market trends – It’s important to analyze market trends and investor sentiment when evaluating a cryptocurrency. Look for cryptocurrencies with a strong community and positive news.

Team – The team behind a cryptocurrency is also an important factor. Look for experienced and reputable developers and advisors.

The Pros and Cons of Making Money With Cryptocurrency Trading

There are both potential benefits and risks to making money with cryptocurrency trading. Some potential benefits include

High potential returns – Cryptocurrencies can be highly volatile, which means there is potential for high returns on your investment.

Decentralized nature – Cryptocurrencies are not controlled by any government or central authority, which can be appealing to some investors.

However, there are also potential risks and downsides to cryptocurrency trading, including

High volatility – The high volatility of cryptocurrencies means there is also potential for significant losses.

Lack of regulation – The lack of regulation in the cryptocurrency industry means there is potential for scams and fraud.

Tips for Successful Cryptocurrency Trading

To be a successful cryptocurrency trader, it’s important to have a trading plan, manage risk, and stay up-to-date with market trends. Here are some tips for success:

Develop a trading plan – A trading plan can help you stay disciplined and focused in your trading decisions.

Manage risk – Managing risk is important to protect your investment and avoid significant losses.

Stay up-to-date with market trends – Keeping up-to-date with the latest news and trends in the cryptocurrency industry can help you make informed trading decisions.

Best Platforms to Trade Cryptocurrencies

There are many cryptocurrency exchanges to choose from, and each has its pros and cons. Some of the most popular exchanges include Binance, Coinbase, Kraken, and Gemini. It is important to compare the features of each exchange and choose one that suits your needs.

The Future of Cryptocurrencies

The future of cryptocurrencies is still uncertain, but many experts predict continued growth and evolution in the industry. As blockchain technology becomes more widely adopted, cryptocurrencies could become more mainstream and play a larger role in global commerce.

However, there are also potential risks and downsides to cryptocurrency growth and evolution, such as increased regulation and government intervention. It is important to stay informed about developments in the industry and to continue to evaluate the risks and benefits of cryptocurrency trading and investment.

Mining Cryptocurrency

Mining is another way to earn cryptocurrency. It is the process of validating transactions on the blockchain network, and miners are rewarded with cryptocurrency. However, mining is not as profitable as it used to be, and the initial investment required to start mining is high. To mine cryptocurrency profitably, you need specialized equipment, low energy costs, and technical knowledge.

Trading Cryptocurrency

Trading cryptocurrency is the most common way people earn money in the cryptocurrency market. It involves buying and selling cryptocurrency on an exchange platform. To make $100 a day with cryptocurrency trading, you need to understand market trends, analyze charts, and have a strategy. However, trading cryptocurrency requires a significant amount of time, effort, and risk.

Real-Life Examples

To better understand the potential to earn $100 a day with cryptocurrency, let’s look at some real-life examples.

Example 1: Bitcoin Trading

Suppose you invested $10,000 in Bitcoin when the price was $10,000 per coin. You could buy ten Bitcoin with your investment. If you sold one Bitcoin when the price reached $11,000, you would make a profit of $1,000. To make $100 daily, you would need to sell 0.01 Bitcoin every day, assuming the price remained constant. However, the price of Bitcoin can fluctuate significantly, making it challenging to achieve this goal consistently.

Example 2: Mining Ethereum

Suppose you invested $5,000 in a mining rig to mine Ethereum. Assuming you had access to cheap electricity, you could earn around $4.50 daily, mining one Ethereum coin. To make $100 a day, you would need to mine 22 Ethereum coins per day, which is unrealistic.

Example 3: Trading Altcoins

Suppose you invested $5,000 in several altcoins like Litecoin, Ripple, and Ethereum. You could buy a significant amount of each coin with your investment. If the price of Litecoin increased by 5% in a day, you could sell it for a profit. Assuming you made a profit of $100 from Litecoin, you could achieve your goal. However, this requires keeping track of multiple altcoins and staying updated on market trends.

Final Thoughts on “Can You Make $100 a Day With Crypto?”

In conclusion, it is possible to make $100 a day with cryptocurrency, but it requires market knowledge, technical skills, and risk tolerance. Trading cryptocurrency is the most common way to earn money, but it is also the riskiest. Mining cryptocurrency is a less profitable option, and the initial investment required is high. Finally, real-life examples demonstrate the challenges

FAQs:

1. What cryptocurrencies should I invest in to make $100 a day?

Investing in more volatile cryptocurrencies like Bitcoin, Ethereum, and Litecoin may increase your potential returns, but also comes with higher risks.

2. Can I make $100 a day with a small investment in crypto?

While it’s possible to make $100 a day with a small investment, it’s important to keep in mind that cryptocurrency prices are subject to significant price fluctuations.

3. Is it possible to make $100 a day with a long-term investment strategy?

While a long-term investment strategy may not yield $100 a day in profits, it can still be a good way to build wealth over time by holding onto a cryptocurrency as its value grows.

4. What are some common cryptocurrency investment strategies?

Common cryptocurrency investment strategies include active trading, buy and hold, and using automated trading bots.

5. What are the risks associated with investing in cryptocurrency?

Investing in cryptocurrency carries risks such as volatility, market regulation changes, and fraud.

6. What is the best way to stay updated on the cryptocurrency market?

Following cryptocurrency news outlets and staying up-to-date on market trends and events can help you make informed investment decisions.

7. Should I consult a financial advisor before investing in cryptocurrency?

It’s always a good idea to consult a financial advisor before making any investment decisions, especially when it comes to high-risk investments like cryptocurrency.

8. How much capital do I need to invest in cryptocurrency to make $100 a day?

The amount of capital needed to make $100 a day in profits varies depending on various factors such as the cryptocurrency you choose, the investment strategy you use, and market conditions.

9. What are some common mistakes to avoid when investing in cryptocurrency?

Common mistakes to avoid when investing in cryptocurrency include investing more than you can afford to lose, failing to do proper research, and falling for scams.

10. Is investing in cryptocurrency suitable for everyone?

Investing in cryptocurrency is a high-risk investment and may not be suitable for everyone. It’s important to carefully consider your financial situation, goals, and risk tolerance before investing in cryptocurrency.

Passive Earning Start Earning Passively Today

Passive Earning Start Earning Passively Today